AP Payments

as a Service

Finexio delivers the only embedded AP payments solution that optimizes, monetizes, and secures the entire B2B payment lifecycle.

Why AP Payments as a Service?

AP Payments as a Service is the most secure way to manage B2B payments. Finexio leverages AI, software, and professional services to offer a complete payment solution with a robust security framework. B2B Payments are changing, and mid-market and enterprise organizations that adopt AP Payments as a Service realize they:

Learn More

Prevent Fraud

By leveraging fraud-detecting AI and maximizing the adoption of secure electronic payments

Reduce Costs

By eliminating manual work, paper, preventing errors, and generating revenue from

AP spend

Save Time

By removing administrative payment tasks and supplier management

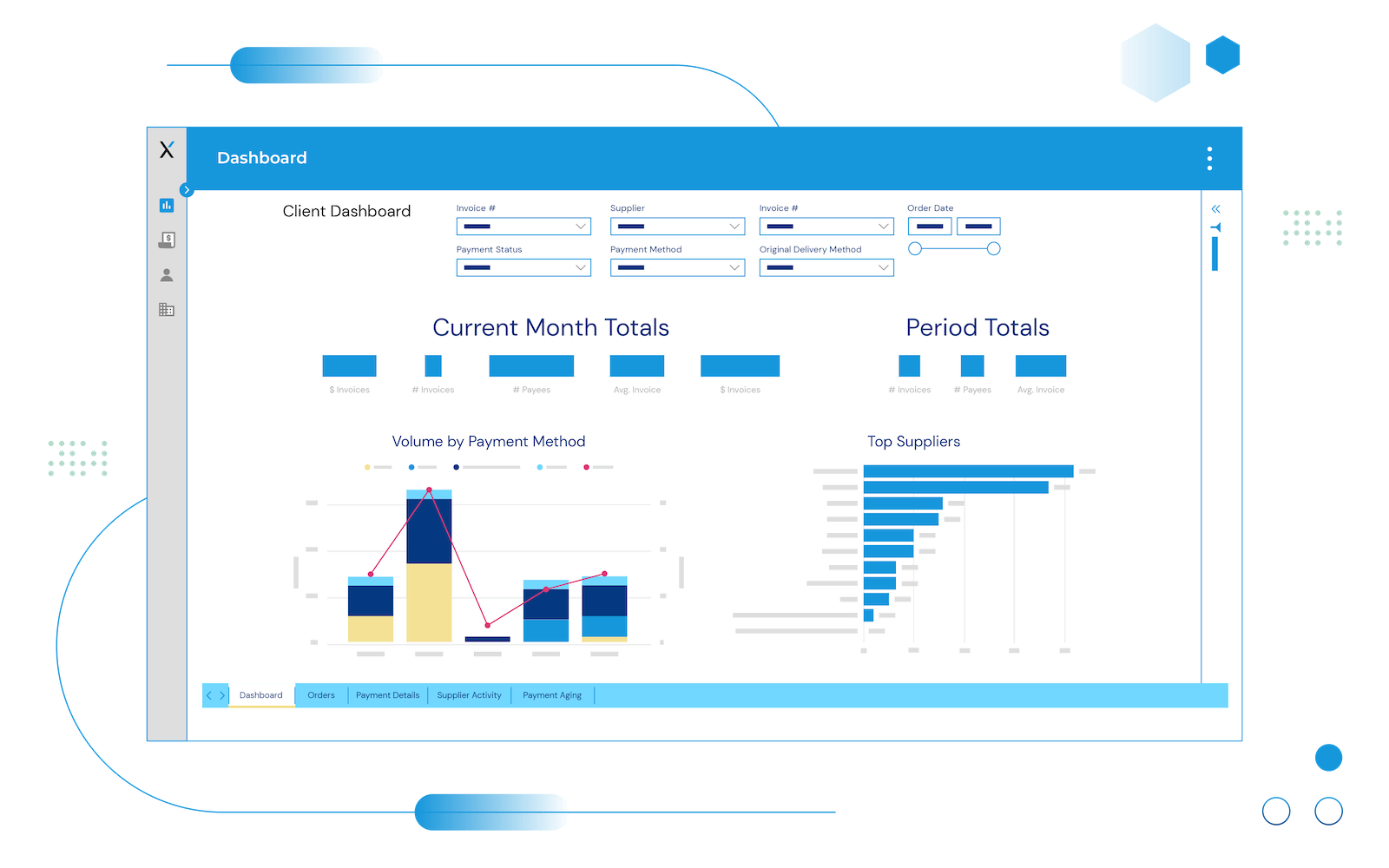

Gain Visibility & Control

With insight into who is being paid, how much, and by what method

“Finexio is a game-changer. When someone can make things easy, it’s worth its weight in gold.”

– Daniel Condon, CFO at Phoenix Stamping

Built For Partnerships

Finexio partners with some of the largest accounts payable software, procurement software, and financial institutions in the United States, offering turnkey Embedded Payments to organizations looking to add AP Payments as a Service offering to their end customers. Finexio is committed to the initial and ongoing success of our partners and their customers, providing comprehensive business and go-to-market services from day one.

Do Less While Saving More

Finexio customers improve their financial position through monetizing and securing their existing AP spend

Pricing

Move from paper checks to safe and secure electronic payment methods from day one.

Starting at:

$1,700/month*

Includes:

*Subject to one-time setup fee

Above $100M in AP Spend? Contact us for pricing

Includes:

"We chose Finexio not just for the revenue share, but for the ease of making payments and the security of those payments.”

– Stephen Krieger, CFO at ViCon Construction, LLC